A simple strategy to save and earn up to 400%

There is a secret in crypto that is not so secret. This is called dollar cost averaging (DCA).

According to Forbes.com, dollar cost averaging is a strategy to manage price risk when you’re buying investments like crypto, stocks, or mutual funds. Instead of investing in a particular asset one time with a single purchase at one price, you divide up the amount of money you’d like to invest and buy small quantities of the asset over time at regular intervals like daily, weekly, or monthly. This decreases the risk that you might pay too much for an investment just before market prices drop.

In simple terms, dollar cost averaging provides a way to ensure that you are buying at the lowest average price without having to figure out how to time the market. Some days you will buy more coins with your regular purchase because the coins are down in price, and some days you will buy less coins at a higher price. But overall your average price is in the middle of the extremes.

If you’re curious how DCA could work for you, check out this calculator available on dcabtc.com:

This picture illustrates that if you bought $10 of Bitcoin every week for 3 years starting 3 years ago, you would have turned $1,570 into $6,200 giving you a +294% return (as of July 2021).

You can also easily run the calculation for all the top 20 coins on dca-cc.

This picture illustrates that if you bought $10 of Bitcoin every week for 3 years starting 3 years ago, you would have turned $1,570 into $10,198 giving you a +550% return (as of November 2021).

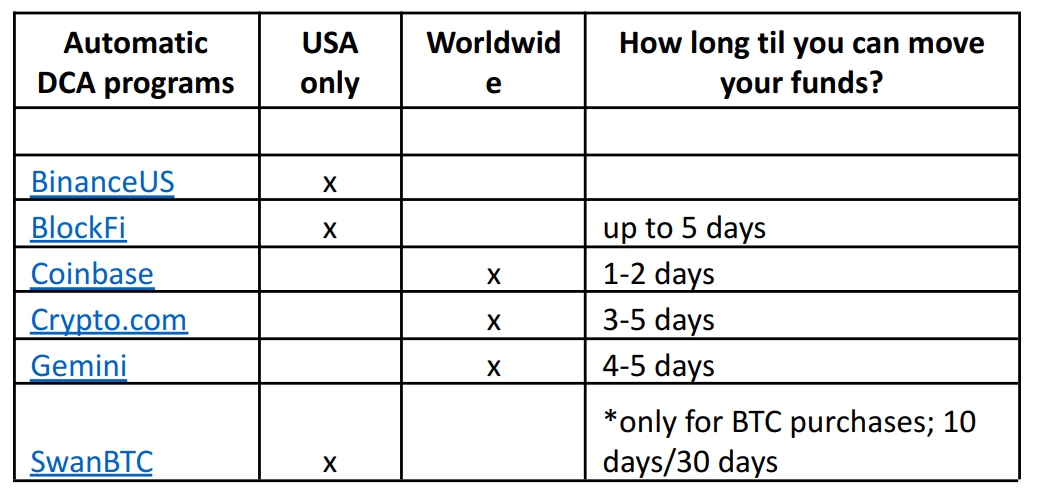

One of the easiest automatic DCA programs to use with the lowest transaction fees is SwanBitcoin.com. The program saves fees by charging you for a year’s worth of processing fees for withdrawals from your bank upfront. You get the best fees if you schedule weekly purchases of at least $50, but you can also choose a daily purchase ($10 minimum, which they withdraw in a lump sum once per week.) Bitcoin can be withdrawn and sent to your crypto exchange or bank for free, but you do have to wait for a holding period of 10 days after the bank withdrawal (or 30 days for amounts over

$2500 in a month). It also offers the option to do one-time purchases. Here are some other options of automatic DCA programs, some of which include DCA purchasing for coins other than Bitcoin.

For more information including our reviews, considerations, and experiences with these DCA platforms, check out our article at SaferCryptoInvesting.com/dca.

Direct links below: