Three Simple Measurements to Track Your Investments

One thing everyone wants to know when they start investing is: how am I doing?

While this question isn’t always easy to answer (especially if you like to make things more complicated by adding multiple accounts, exchanges or brokerage accounts, and trading strategies!), here are three simple ways to help a beginning investor measure their results.

If you're a beginning crypto investor, check out our post 6 Basic Tools for Investing in Cryptocurrencies.

1. Write it down

The simplest method of tracking your investments recommended by our mentor, Dan Hollings, creator of The Plan, is to get a journal and write down two numbers each day:

- The date

- The amount your portfolio is worth

This method of tracking is easy enough for anyone to do. You might even think it’s “stupidly simple”, yet it is very powerful to watch the number slowly tick up in value over time. You can choose how often you want to update this number: daily, weekly, monthly, or even randomly. With a good investment strategy in place and enough time, you may be pleasantly surprised at how much your investments have increased from where you started.

2. Divide and Conquer

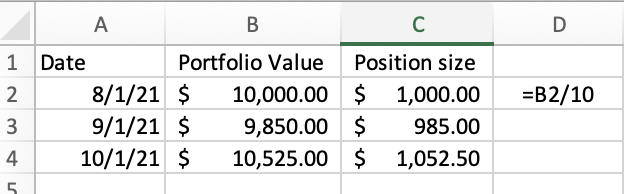

Many trading gurus recommend allocating a certain amount of capital to each trading position. For instance, if you have a portfolio with ten positions and the whole portfolio is worth $10,000, you will have $1,000 for each position. However, as your trading progresses, the value of your portfolio will also fluctuate. So the question becomes: do you continue adding $1000 positions as your portfolio grows or do you stick to a ten percent division of your capital?

Twenty-two year veteran trader Sean Donahoe, who recently released a trading method for cryptocurrencies emphasizing the ten largest coins and using TradingView software called Rebel Crypto Trader, recommends the ten percent method for his students. The easiest way to figure out your investment position size is as follows:

- At the beginning of the month, write down the value of your portfolio.

- Divide your portfolio value by the number of positions. This is your position size.

- At the beginning of the next week/month/other time period, write down the value of your portfolio.

- Divide your new portfolio value by the number of positions. This is your new position size.

- Repeat.

As your investment portfolio grows or shrinks, the value of each position would also change proportionately. Figuring out the new position sizes can be as easy as keeping a basic spreadsheet with the following numbers:

- Date

- Current value of portfolio

- Portfolio value divided by the number of positions

(the spreadsheet formula for this would be

“=(click on box with portfolio value)/(number of positions)” example: =B2/10

This method of dividing your capital among your different positions could also be used to track your investments if you have multiple trading strategies. For instance, if you are a student of Dan Holling’s The Plan, Sean Donahoe’s Rebel Crypto Trader, and also follow a cryptocurrency newsletter recommendation service, you might want to allocate a third of your capital to each strategy and then see which one performs best. (Or you might want to stick with the winning strategy and simplify your investments a little!)

3. The Percent Return

Finally, the simplest way to report your overall success in investing is to know what your percent return is on your portfolio. After all, it’s much easier to say, “I’m up 50%” instead of a ten minute explanation of how your $1000 increase in your $2000 portfolio compares to your neighbor’s $1000 increase on his million dollar portfolio.

Calculating this return is very simple: Divide the current value of your portfolio by the amount you started with. (Example: $3000 / $2000 = 50%)

Where it gets complicated is that most people don’t have just one strategy or start with one lump sum and never change the amount of initial capital. How do you keep track of your Percent Return if you added $5000 last month but took out $3125 for bills this month? Not to mention if you have accounts spread across multiple exchanges.

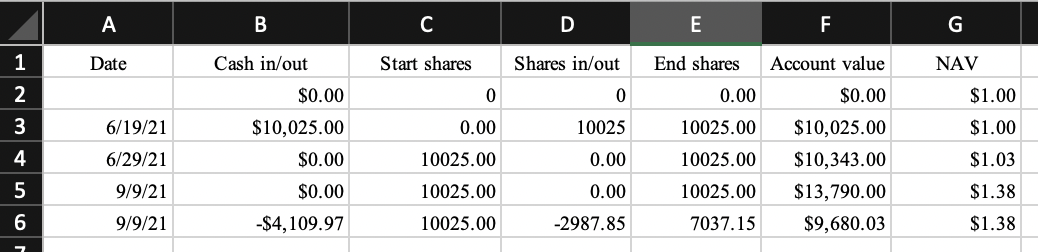

A method I’ve been using for years is to keep a spreadsheet that tracks your inflows and outflows of money, similar to how a mutual fund company tracks its Net Asset Value. (Net Asset Value, or NAV, is calculated by adding up the total assets in the fund, subtracting the total liabilities, and then dividing the amount by the current number of shares. This number is the basis for the price assigned to a share of a mutual fund each day.) In this case, your NAV is the total amount you have invested divided by the number of “shares” you own.

The magic happens in calculating your “shares”.

With a few simple formulas populating the spreadsheet boxes, you too can easily track your investments, no matter how many accounts, strategies, inflows, or outflows to your capital.

If you’re the sort of investor or trader who has a multitude of trading strategies, platforms, exchanges, etc., this method of tracking can be easily adjusted to exponentially simplify your measure of success. With resources spread across many categories, keeping a spreadsheet that tracks their current value and adds up the totals for you can be invaluable to help you know if your strategies are working or when it is time to make an adjustment. And, set up correctly, it should take just a few minutes to fill in the current values of your various accounts and obtain an accurate number to measure your success.

If you’d like to learn more, send an email to [email protected]. If there’s enough interest, we’ll create an easy mini-course to help you simplify, understand and easily track your investment portfolios (including stock, crypto, and other investments), no matter how complicated they are! (And if you have been investing for a while and not tracking before now, we can show you how to reconstruct your history with a minimum of effort.)

In the meantime, have fun investing. And keep track of your numbers so that you can brag about them later!