Sneaky Airdrops, Dust Attacks, and Tax Consequences

Last year, I finally “got into crypto”, meaning that I opened my first exchange and made my first purchases of cryptocurrencies.

I had thought about getting involved with cryptos before, but I had heard too many rumors about scams and complications and I didn’t think that I had the time to research how to be safe with crypto investing. So I bought some Greyscale Bitcoin Trust shares and hoped for the best.

(For the record: I would’ve made a LOT more if I had bought Bitcoin directly!)

In any case, I bought a course that helped me learn how to open an exchange and get some money into it, which led to another course that taught me how to open a wallet and move money into it….and now I’m blogging about how to be safe with crypto and how to do your crypto tax reports!

The thing is: cryptocurrency investing is still a little like the “Wild West”: sometimes you need to be really careful and aware of what is happening or you might get scammed.

Which brings me to airdrops.

Airdrops I Didn’t Ask For

In September of last year, I set up a Metamask wallet. I sent some money to it, interacted with some DeFi protocols, and took some money back out.

Little did I know that opening a Metamask wallet can expose you to scammers.

How?

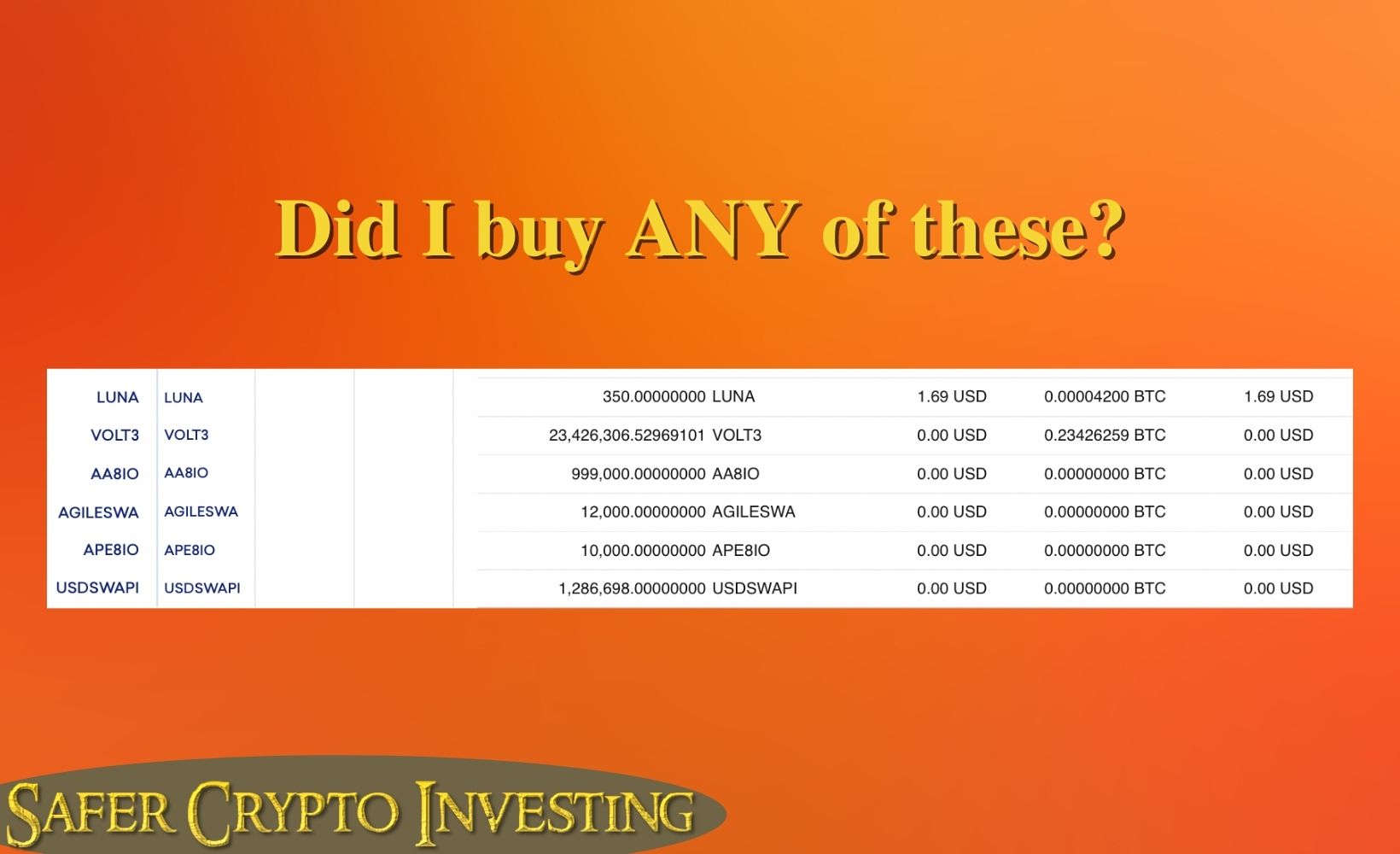

Well, when I purchased some crypto tax reporting software six months later (here’s a review of the software I recommend) and hooked up my Metamask wallet, I learned that I had coins that I had never heard of in my wallet! (What is this AA8I0, Agileswa, or USDSwapi?)

So I’ve been doing some research about airdropped junk coins.

It seems that some unscrupulous characters and nefarious villains will go look up your wallet address on the blockchain and then send you some of their amazing cryptocurrency tokens.

Since a wallet address is publicly listed whenever you make a transaction on the blockchain, it turns out that there’s not much you can do about receiving these coins. Which can have tax consequences, of course.

Why do they airdrop coins into your wallet?

In most cases, it seems the nefarious scammers are trying to get you to interact with their tokens.

They might attach a note to the airdrop that invites you to go to a website to fully claim the coins. This is known as a phishing attempt.

If you were to go to their website and enter your information (especially your secret keys) or approve a transaction, then the scammer obtains access to your wallet and can clean it out (steal all of your legitimate coins).

Never ever EVER go to a dubious website and let them trick you into entering your secret keys or approving a transaction in your wallet!

A second way the scammers might be trying to attack you is to track your interactions with the airdropped coins.

This is often known as a “Dusting Attack”. By dropping what looks like a lot of coins into your wallet, they are hoping you will try to exchange the coins and then they can track your wallet movements and potentially “deanonymize” the wallet.

In either case, the best way to deal with this airdropped junk is to just ignore it.

If you don’t interact with the coins, your wallet information can’t be hacked and you can’t be tricked into giving up your secret keys or approving of transactions that could potentially rob you.

Metamask and Tax Software

Luckily, Metamask doesn’t even show you these airdropped junk coins. Unless you add a coin to your wallet, you will never know how much of that coin you might own.

Which is where the tax software comes in.

When I added the wallet address for my Metamask accounts to my crypto tax reporting software, it pulled in every coin listed for my address.

It turns out I had several that I had no idea about.

And sometimes they’re sneaky: one of the coins listed in my wallet network imported as a coin called LUNA. (Not to be confused with the very legitimate LUNA2 in the tax software, which is the Luna token for the Terra network.) I spent some time trying to figure out why I have 350 Luna tokens in a Binance Chain wallet until I realized that it was Luna Coin, and not LUNA.

So do airdropped junk coins have tax consequences?

Maybe.

Most countries want you to report receipt of any cryptocurrency with a value as of when you received it. This is usually reported as income and taxed at ordinary income rates. Later, when you sell the coins, you will have a cost basis established (the part reported as income) and then will pay capital gains tax on the difference between what you sold it for and what the cost basis was. (Capital Gains rates are usually lower than Ordinary Income tax rates.)

However, airdropped junk coins are a bit of a grey area.

Are they worth anything?

Sometimes the wallet will list them as being worth lots of money, but if you tried to sell the tokens, would you actually receive that amount of money?

Some countries, like the United Kingdom, realize that airdropped junk coins that were unsolicited and un-asked for are not legitimate income to the receiver, even if the tokens claim to be worth a lot. The UK only taxes you if you did something to earn the crypto, such as signed up for a newsletter or sent a tweet.

Other countries, such as Australia and the USA, want you to report the value of the tokens received. If you keep good records that the coins were worthless, chances are good that you can prove the coins were worthless when you received them if you were ever to get audited or questioned by the tax authorities.

In the meantime, the best thing you can do for your safety is to ignore anything that appears in your wallet without your permission.

Check for social media mentions or on airdrop sites that list legitimate airdrops for coins that you recognize in your wallet. (Hint: usually you signed up for them somehow….) And leave the others alone!

![]()

How Your Tax Software Can Help You Classify Your Junk Coins

CoinTracking has a feature in their software where you can mark certain token addresses as blacklisted. Usually, if you delete a transaction in the software that is imported by API or a public wallet address, the transaction will reappear in your reports the next time the job updates.

But if you blacklist the questionable token, then CoinTracking will not re-import the transaction and you can safely delete it and forget all about it.

You can also filter your tax reports to exclude airdropped tokens if you know that all of the airdrops you’ve received have been junk coins or dust.

Whatever you do, be careful out there!

Want to save money on your subscription to our favorite crypto tax reporting software?

This link will give you a 10% off discount for all paid plan levels, but if you want to save 25% off the annual unlimited membership and learn more if it's the right choice for your situation, check out our new Quiz: "Which Crypto Tax Solution Is Right For You?")

Disclosure: You should assume any links in this blog post are 1. affiliate links, 2. links to our own products, or 3. links for your convenience. We only recommend products that we whole-heartedly endorse and any commissions earned from your purchases do not increase your costs.

Sources for this story include:

More about airdrop scams:

https://www.bsc.news/post/airdrop-scams-minereum-mneb-and-velochain-velo-land-on-binance-smart-chain

Dusting attacks:

https://beincrypto.com/learn/dusting-attack/

https://support.ledger.com/hc/en-us/articles/4410970438929-What-is-a-dusting-attack-?support=true

Airdropped scams and Taxes:

https://fullycrypto.com/do-i-pay-tax-on-a-scam-airdrop

https://www.blog.cointracking.info/receiving-a-crypto-airdrop-taxes